Resource Center/Article • 12/14/2020

2020 Peak Season: E-Commerce Consumer Spending Insights

How, why, and what are E-Commerce consumers spending their money on during the 2020 Peak Holiday Shopping Season? Dig into key data thus far!

For a variety of reasons, this year’s Peak Season is unforgettable. Riddled with carrier capacity concerns, rising shipping costs, complex consumer expectations, and a massive wave in E-Commerce sales that began even before Peak, this Peak Season is uncharted territory for shippers, carriers, and consumers alike.

To gain some clarity into what’s happening across the Parcel and LTL industries, consumers remain a great indicator. How, when, and why they spend can tell us much about the industry’s present and future state. So, let’s dig into how consumers are spending this Peak Season thus far1.

It’s no secret that the November shopping season has increasingly become more and more E-Commerce centric. In the past, E-Commerce has offered consumers convenience, free shipping, and a variety of discounts/sales. Through a pandemic lens, E-Commerce also brings new peace of mind in its ability to prevent close contact with others, but also continues to open doors to additional inventory or items that simply aren’t nearby (as we’ve often seen brick-and-mortar stores lack full inventory these last few months, especially when it came to exercise equipment).

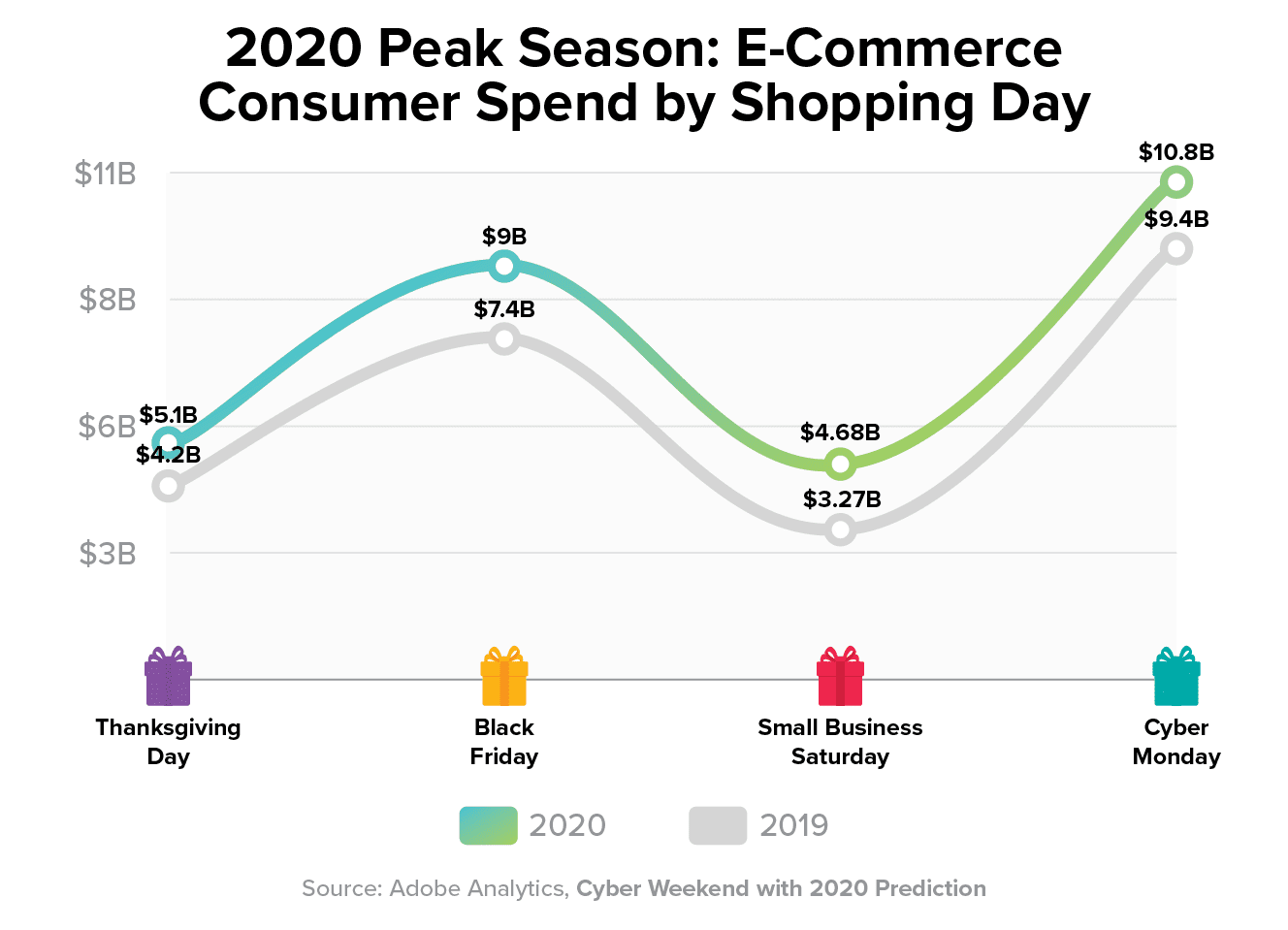

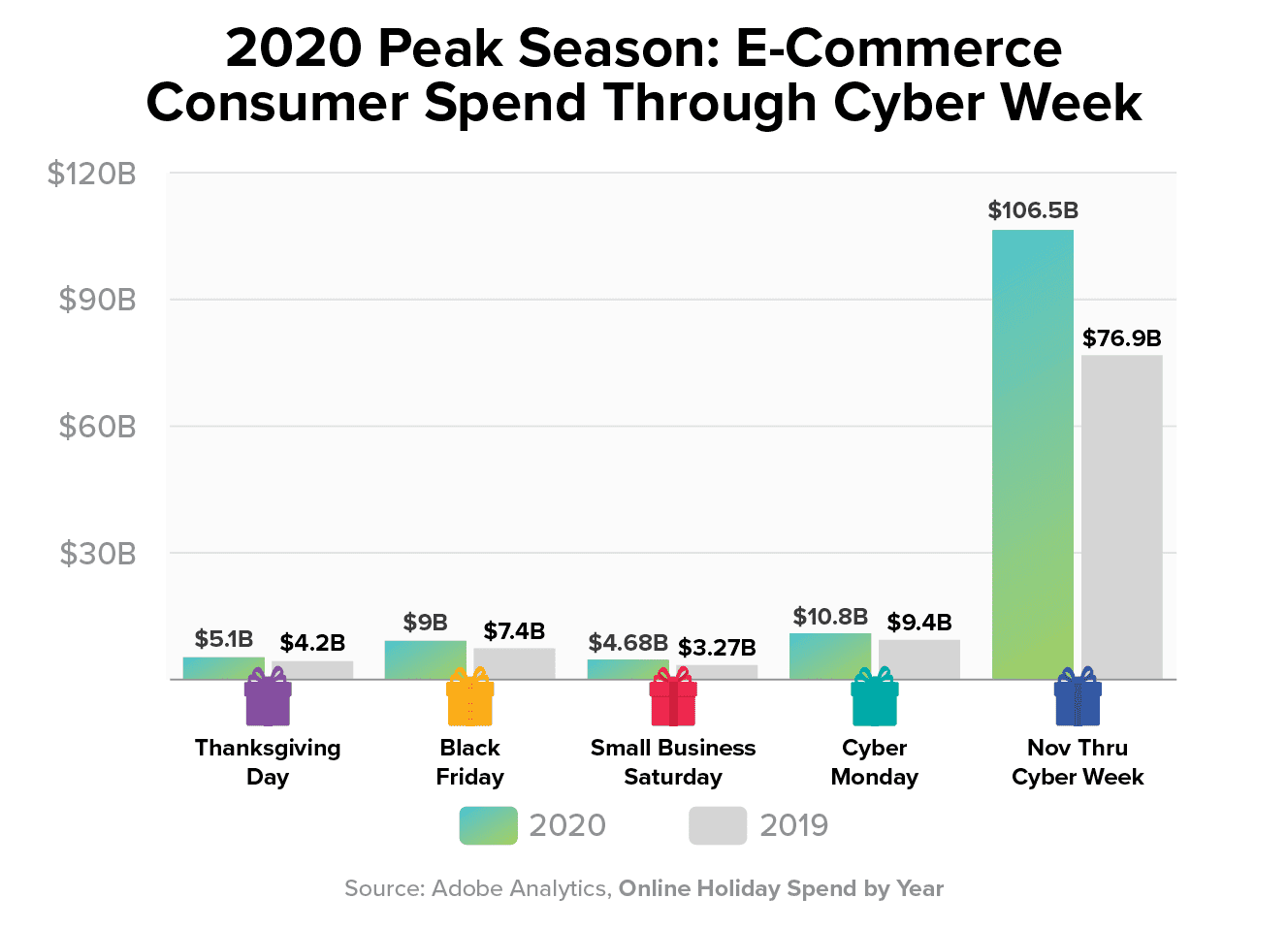

Though E-Commerce sales certainly were up Year-Over-Year for all four of November’s big shopping days2, these numbers frequently fell into the lower range of previous estimations by industry analysts. Yet interestingly, consumers still spent nearly $30B more during this period compared to 20192, indicating that consumers spent outside traditional shopping days and likely headed messages from brands to shop early. In fact, the National Retail Federation found in its own survey that 59% of E-Commerce shoppers had begun their holiday shopping before the month of November3.

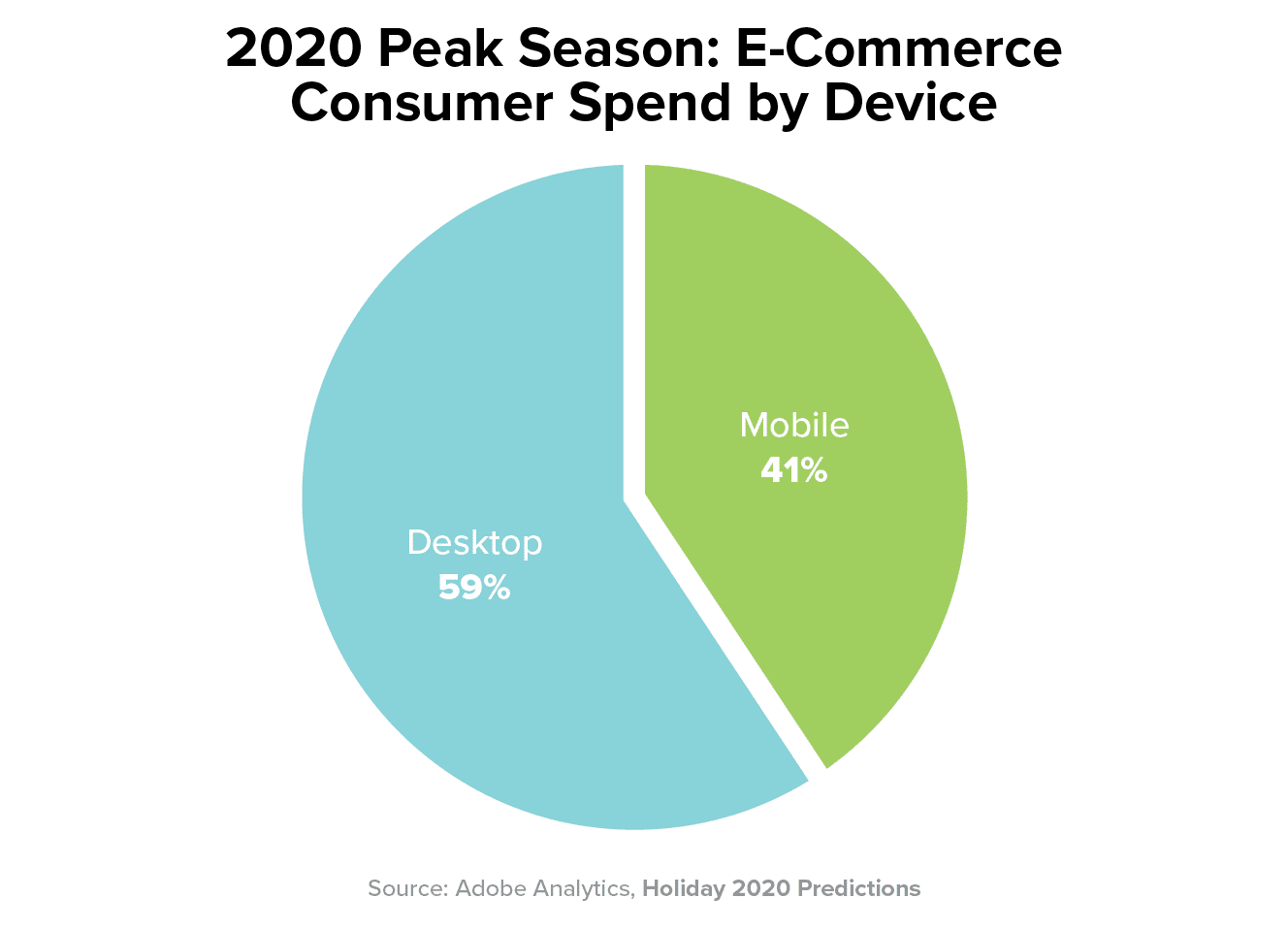

41% of E-Commerce sales during this period have been attributed to mobile devices, meaning that the mobile influence on consumer spending is increasing; however, mobile spend still defers to a nearly 60% desktop majority.

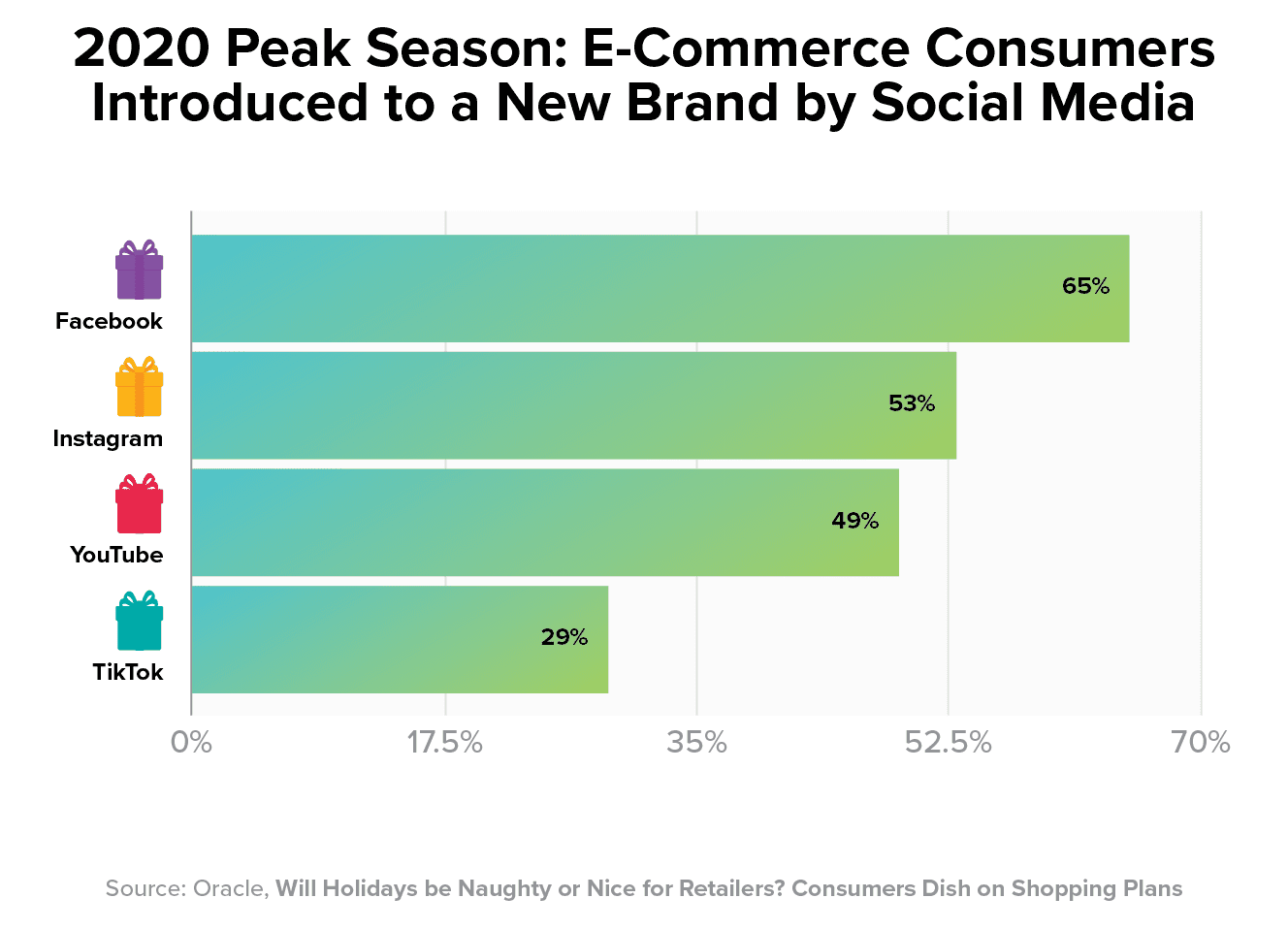

Traditionally, the world has largely assumed that until shoppers can easily and quickly compare items, prices, and perhaps even seek out coupons via a mobile device, it’s unlikely that mobile spend would surpass desktop spend. However, this year saw a notable upward trend in social media’s influence on consumer spending. During a holiday shopping survey, data analyst company Oracle found that 48% of respondents found a new brand they had, or planned to, purchased from via social media. Which makes one wonder if the perceived convenience of social media advertisements and sales could possibly someday eclipse or surpass the desktop experience.

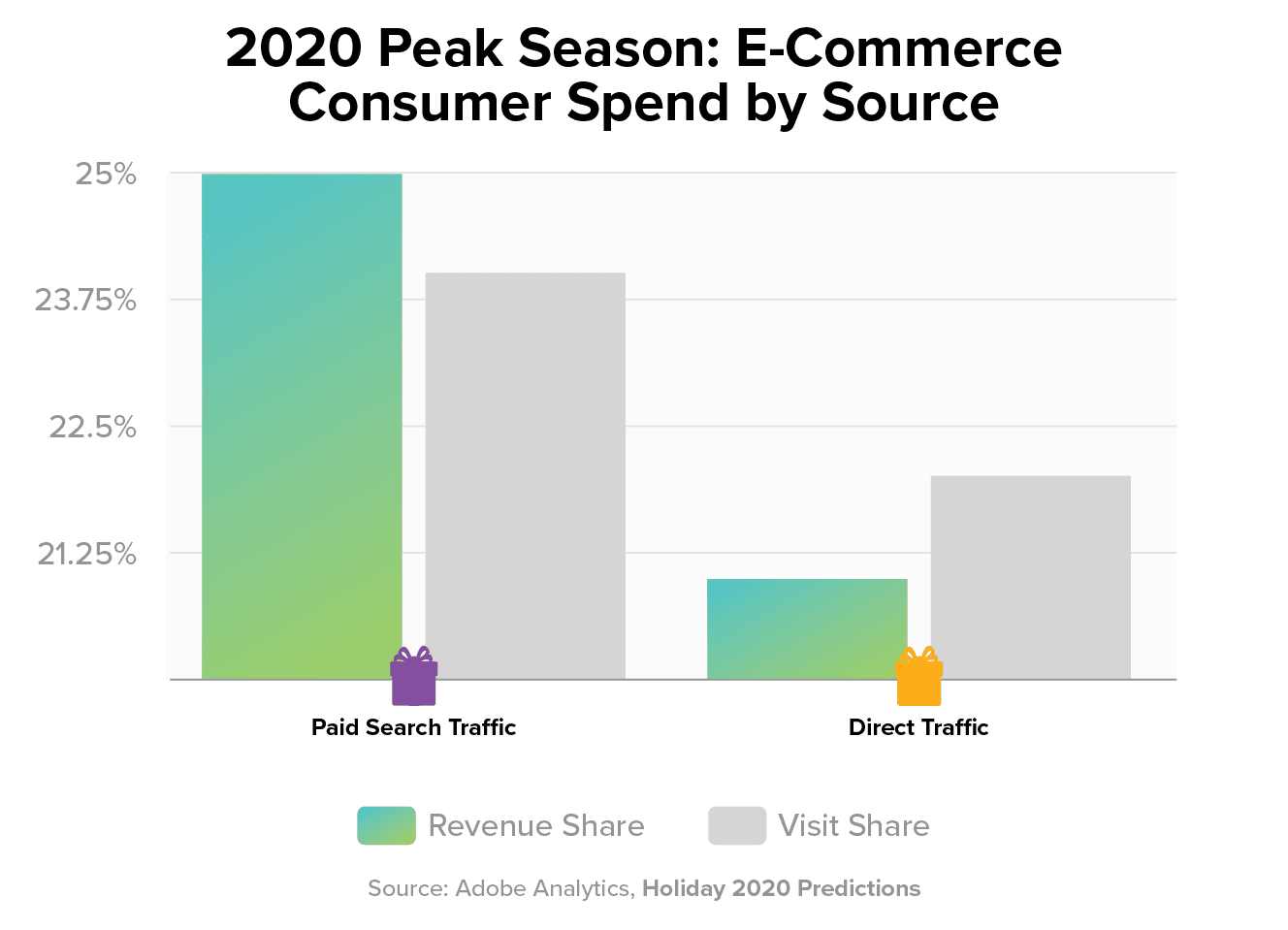

No matter the device though, E-Commerce sellers are certainly seeing a return on investment in regards to their Paid Search Traffic efforts. When it comes to search advertisements, Adobe Analytics found that there’s higher revenue to be earned from those clicking paid search advertisements than those that visit an online store directly by entering the url into the browser’s address bar.

There is one notable question on everyone’s mind when it comes to E-Commerce shopping this Peak Season: are consumers more likely to select BOPIS or Curbside Pickup vs. Same Day or standard shipping options? Meaning – do consumers still prefer the convenience of having items shipped to their homes, or have they learned through the pandemic to pick these items up themselves and forgo shipping altogether?

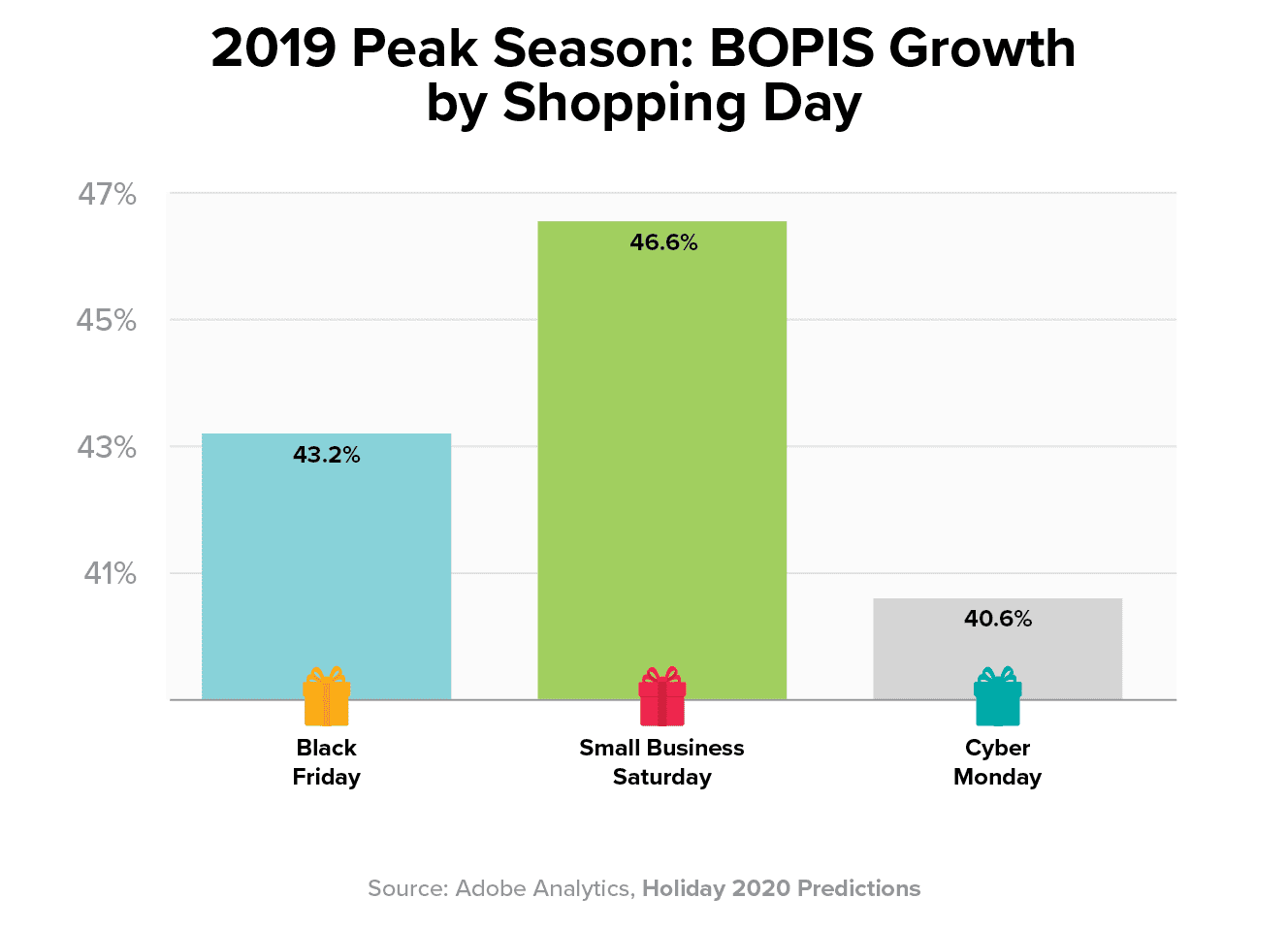

Well, we’re still waiting to see the data results behind this type of question; however, looking back at Adobe Analytics 2019 reporting, we can see that BOPIS was growing into its own even last year. Out of the five major November shopping days, BOPIS saw at least a 40%+ uptick in Year-Over-Year sales on Black Friday, Small Business Saturday, and Cyber Monday.

In its previously mentioned survey, Oracle also found that 34% of its survey respondents would prefer BOPIS or Curbside Pickup to traditional shipping options tells us that we will indeed see a healthy percentage of E-Commerce consumers choose BOPIS or Curbside Pickup this Peak Season. Will this mode surpass or retire shipping methods? Most definitely not; however, it is likely that the consumer’s expectation for fast shipping, or at least their demand for Same Day or Next Day shipping, will most likely not be a priority to their purchase decision.

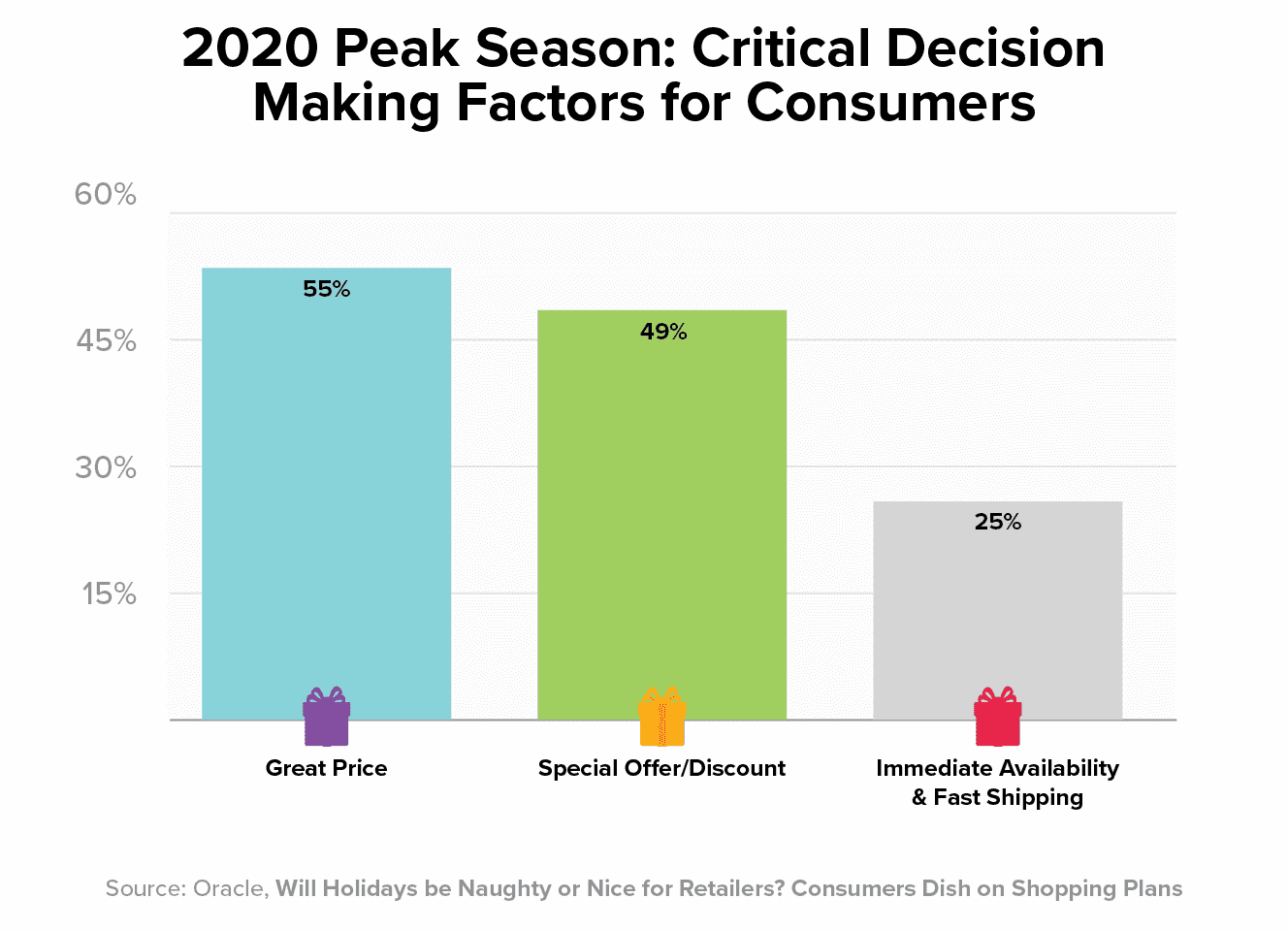

So what are the critical factors at play for E-Commerce consumers in deciding whether or not to purchase?

Well, Oracle says price remains the most critical decision making factor, followed by special offers or discounts, and then fast shipping or immediate availability – another reminder that Same Day or Next Day shipping is likely not a priority this Peak Season, while BOPIS or Curbside Pickup gain ground.

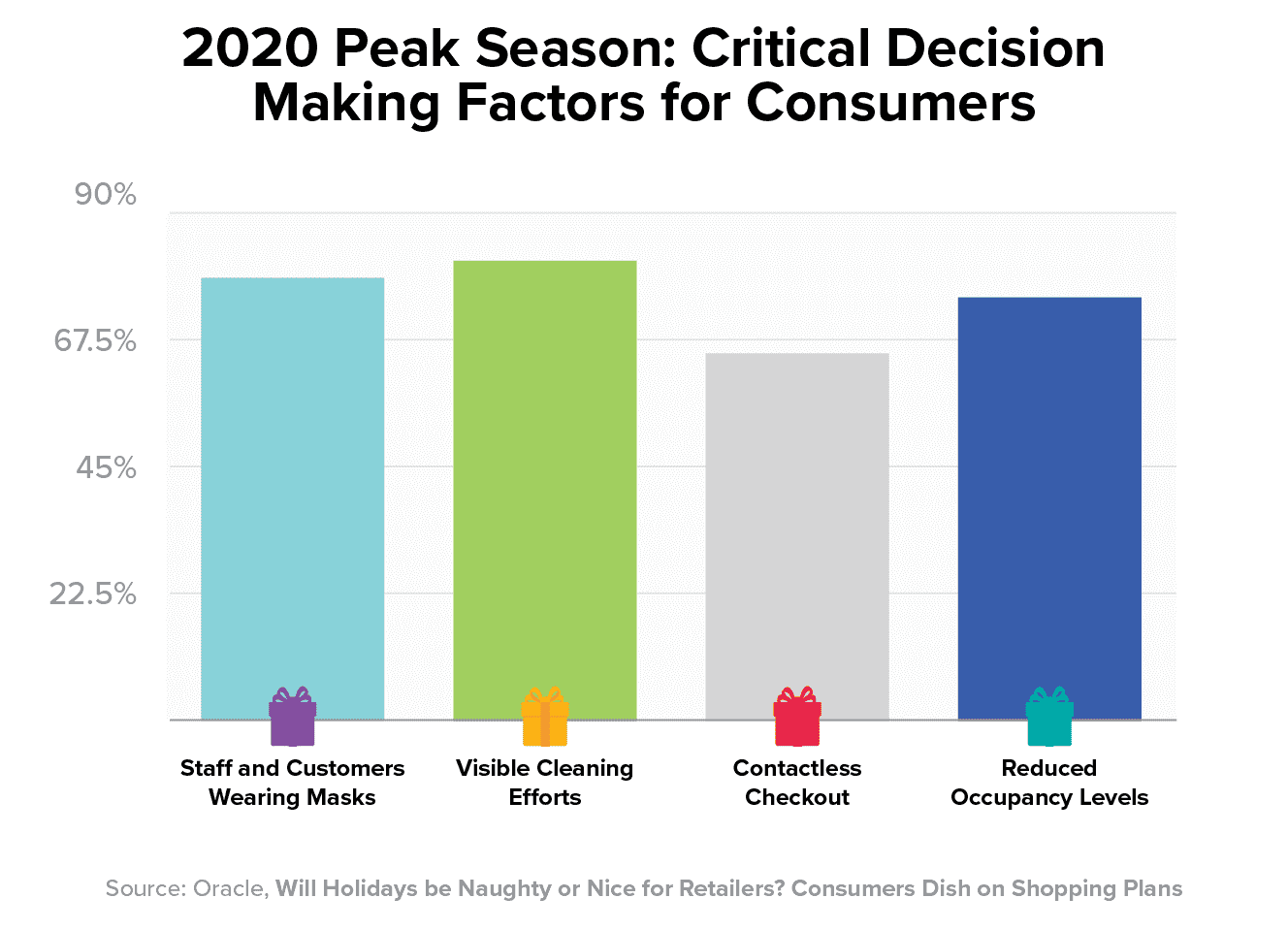

But what about the in-store experience? We know BOPIS and Curbside Pickup customers have some likelihood of deciding to travel in-store and peruse shelves for themselves, leading to upsell opportunities. So what are the critical factors in making consumers feel safe shopping in-store? Once again, Oracle says visible cleaning efforts, masks, reduced occupancy, and contactless checkout are all critical.

With a total E-Commerce spend of $106.5B during this period2, it’s been a record Peak Season thus far; however, record sales are often followed by record returns, particularly during Peak.

It is generally accepted that 20-30% of E-Commerce sales are returned7, which could mean $21.3B or $31.9B for this particular period alone. Such a possibility reinforces the need for E-Commerce brands, or E-Commerce enabled brands, to have a strong returns strategy.

An estimated 70% of consumers consider the return policy of a store before committing to a purchase5, and if that’s not valuable enough – 92% of consumers say they are more likely to buy again from a seller that has a convenient and easy returns process6.

E-Commerce continues to play a massive and influential role in consumer spending behavior – a truth magnified by the pandemic and realized in both the months leading up to and during Peak Season.

Shoppers have spent a record $106.5B so far, and they’re largely doing that with pandemic safety and economic concerns at the forefront of their decision making – how safe they feel in-store or picking up curbside from a store is just as critical a priority to them as pricing. With safety and convenience on the rise in consumer decision making, fast or expedited shipping are less important than in years past (though still appreciated).

For shippers, realtime inventory management and clear customer communication are becoming more and more critical. Omnichannel network strategies are on the rise, and for good reason. When E-Commerce sellers can clearly communicate what and when products are available, as well as provide a variety of pickup options (in-store, BOPIS/Curbside, shipping), finding the consumer and meeting the critical factors in their decision making becomes that much easier.

How will the rest of Peak Season turn out, and what will we learn from the period overall? That’s one Christmas pudding we can’t wait to see the proof in (and eat).

Share this page: